Toronto home prices faring better than some, 2 years after FHP

By Penelope Graham on Jun 05, 2019

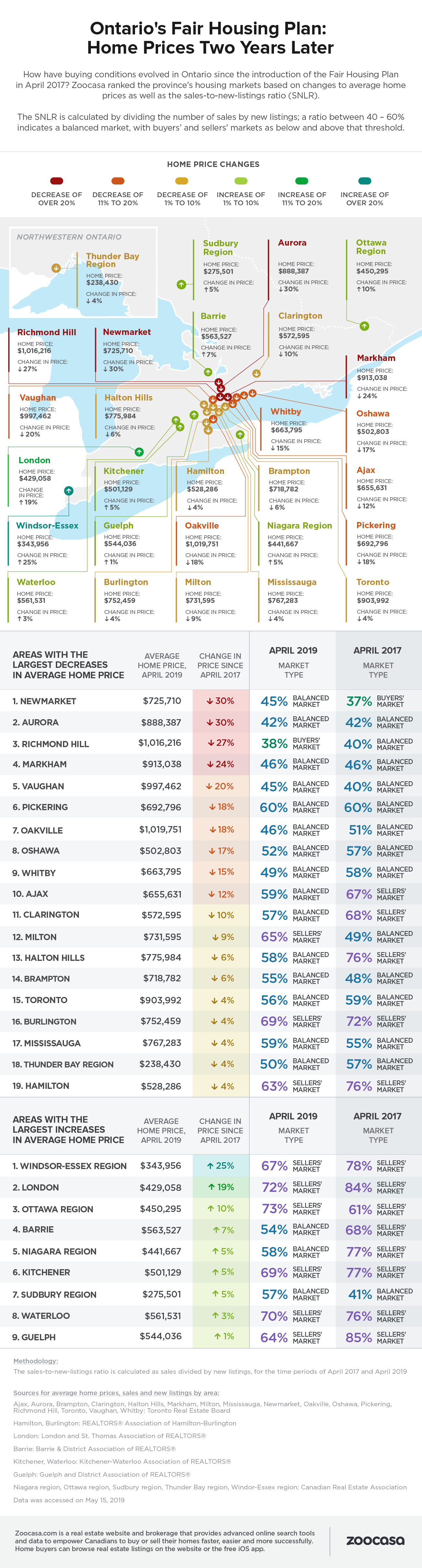

To say that the housing market has weathered a lot of change over the last two years would be an understatement – not only have prospective home buyers’ budgets been chopped by the federal mortgage stress test, but Ontario markets have had to absorb the impact from a set of new housing rules revealed in April 2017.

The Fair Housing Plan was introduced by the former Liberal provincial government as a solution to runaway home price growth; year-over-year values had spiked over 30% in the Greater Toronto Area, prompting concerns of speculative and unsustainable investment. In response, Premier Kathleen Wynne unveiled the province’s own 15% foreign buyers tax (called the Non-Resident Speculation Tax), improved rent controls for units across the province, and introduced a number of initiatives to boost supply and free up land for development.

So, did the FHP work?

While it remains to be seen whether these specific measures are entirely responsible for chilling prices, the psychological impact was apparent – in the following months, sellers panicked at the thought of missing out on the market’s price peak, listing en masse and flooding the MLS with inventory while buyers took a wait-and-see approach to see if prices would come down from their stratospheric heights.That all led to a price correction, the aftermath of which is still apparent in some of the province’s main markets, according to new data from Zoocasa. The study, which compares average sold home prices in April 2019 to the same time period two years ago, reveals which municipalities have experienced a downturn in prices, while others have seen a long-term improvement.

Some communities harder hit than others

For example, in York Region - a cluster of municipalities located to the north of Toronto - home prices plunged around 30%, below the $1 million mark. However, they remain in an overall higher-end price range and have a longer proximity to the urban downtown core, which has left them a less desirable option for those trying to enter the market. These communities were also a draw for both domestic and foreign investors, as well as home flippers; cooling market conditions have led to a drop in demand from these buyer groups, further depressing prices in the region.In contrast, prices for Toronto real estate were relatively unscathed, dipping just 4% to a still-pricey average of $903,992. As well, while market conditions have softened somewhat over the last two years, they remain at the tighter end of balanced with a sales-to-new-listings ratio of 56%, which indicates the factors that support price spikes – such as bidding wars – are still alive and well in the city.

Other markets, such as Windsor-Essex and London, actually saw values rise at a sizzling pace, rising 25% and 19%, respectively, though still at an affordable entry point to the market at averages of $343,956 and $429,058. Both of these cities are experiencing searing seller’s conditions; 67% of all new listings brought to the Windsor market in April sold, while a whopping 72% of the new supply in London changed hands.

Check out how prices and market conditions have changed across Ontario between April 2017 and 2019 in the infographic below:

Penelope Graham is the Managing Editor at Zoocasa, a tech-first real estate company that combines online search tools and a full-service brokerage to let Canadians purchase or sell their homes faster, easier and more successfully across the nation, including Mississauga homes for sale and Barrie real estate. Home buyers and sellers can browse listings on the site, or with Zoocasa’s free iOs app.