Only those within the top 10% of earners can afford a Toronto house: study

By Penelope Graham on May 02, 2019

It’s no secret that buying a home can be prohibitively expensive in Toronto. Even as housing prices have cooled throughout the GTA since the 2016 market peak, the average house still fetched $873,100 as of March, while the typical condo unit costs over half a million dollars, at an average of $522,300.

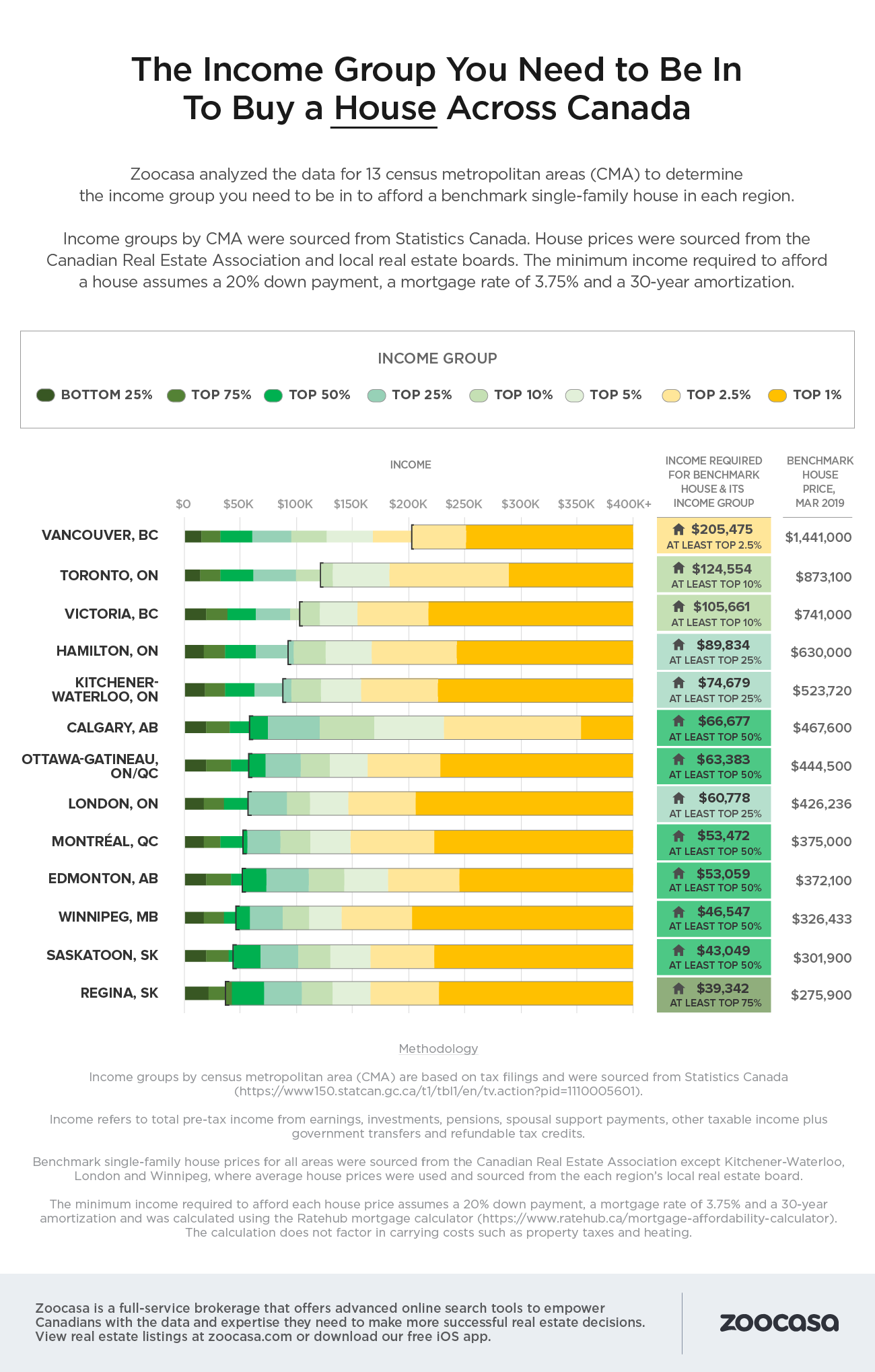

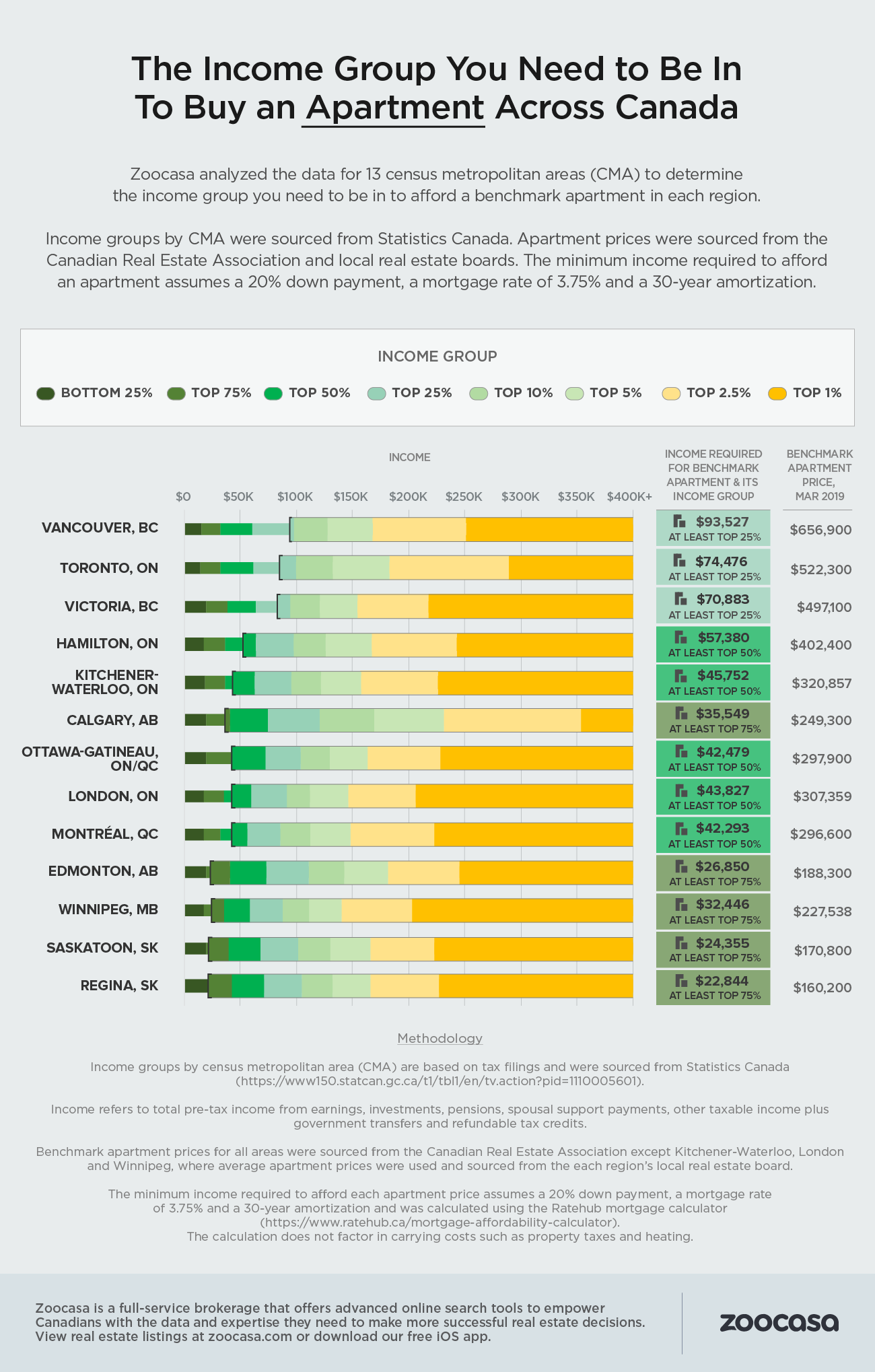

A new study from Zoocasa puts those financial challenges into even sharper perspective; as it turns out, buying a house in the city is only possible for those within the top 10% of income earners – earning a minimum of $124,554, while condo buyers – typically millennial and first-timers – must still fall within the top 25%, earning at least $74,476.

The study determined the minimum income thresholds for buyers in 13 major cities across Canada by sourcing benchmark home prices from the Canadian Real Estate Association. It then calculated, based on a 20% down payment, 3.75% mortgage rate and 30-year amortization, the minimum income needed to qualify for a mortgage on the average home, which was then cross-referenced with income tax filings in each city, as reported by Statistics Canada.

Real estate for elite earners only in hottest markets

The numbers certainly shed light on just how unaffordable Canada’s largest urban centres can be. Not surprisingly, Vancouver buyers are in the tightest financial straits, needing to earn over $250,000 to afford the average $1,441,000 house – an income threshold achieved by only the top 2.5%. West-coast condo buyers must also be relatively well-heeled, earning a minimum of $93,527 to buy the average $656,900 unit – within the top 25%.Prairies offer best affordability

However, the report also underscores how widely buying conditions can range in markets across the nation. For example, real estate affordability is greatly improved in the prairie provinces, as well as some of Ontario’s secondary markets.Regina took the top spot for overall affordability; buyers within the Saskatchewan city need only be within the top 75% of earners to afford both a house or condo. This is due to prices remaining well aligned with local incomes: houses cost an average $275,900, while the average condo can be had for $160,200, a fraction of the prices found in other markets.

Saskatoon, Winnipeg, Calgary, and Edmonton also rank very highly for home affordability, with those within the top 50% of earners able to own a house, and 75% able to purchase a condo.

The minimum income thresholds to purchase houses and condos in each of the cities studied can be viewed in the infographics below:

Penelope Graham is the Managing Editor of Zoocasa.com, a real estate website that combines online search tools and a full-service brokerage to let Canadians purchase or sell their homes faster, easier and more successfully across the nation, including Edmonton homes for sale, London condos for sale, and Waterloo real estate. Home buyers and sellers can browse listings on the site, or with Zoocasa’s free iOs app.